Break Free from High Rates and Extra Fees with a Credit Card from Your Credit Union

You’ve probably seen the ads or get the offers in your mailbox. Financial institutions – big and small – are vying for a credit card slot in your wallet. With bank fees and interest rates on the rise, a credit card from a credit union could make better financial sense than a traditional bank-issued card. Here’s why.

Lower fees

Credit unions are not-for-profit and owned by members. Because they don’t have to pay investors, members can expect fewer fees. Only about 10% of credit unions charge annual fees for credit cards, compared to 45% of banks.1 Maximum late payment fees are also 50% more at banks, on average.1 With foreign transaction fees, banks charge almost double what credit unions do.2 And most credit unions don’t charge anything for balance transfers, while you can expect to pay between 3% and 5% at most banks.3 All that’s true for the Navigator Platinum Rewards card which charges no annual fee, no balance transfer fee and no cash advance fees.

Lower rates

The annual percentage rate (APR) is another area where you could save by choosing a credit union. Credit card APRs are generally lower on credit union cards. Right now, new Navigator Platinum Rewards cardholders can qualify to take advantage of a limited-time offer of 4.99% APR on purchases for the first six months. When the introductory period is over, the rate reverts to the regular rate which is significantly lower than that offered by most banks and store credit cards. Regardless of the APR, remember you can avoid any interest charges by always paying your bills on time and in full.

More willing to work with bad credit

Credit unions are more likely to work with people who have a less-than-stellar credit history to find the best solution for them. Navigator’s Share Secured Visa® Card is an invaluable tool whether you’re looking to rebuild credit or establish credit. Your secured credit card is backed by a cash deposit. The deposit is usually equal to the credit limit to make purchases. You get the deposit back when you upgrade to a regular “unsecured” card or close the account in good standing. As you use the card, Navigator reports your activity to all three credit bureaus. Keep your balance relatively low and pay your bill on time every month, and you can begin to strengthen your credit. In addition, Navigator’s Platinum Reward card credit score requirements are set to allow more Members to qualify, even many who might not meet credit score requirements of other financial institutions.

Better customer service

Large banks have millions of customers from around the country. At a local credit union, you can expect a more personalized experience. If you have any questions or concerns regarding your credit card from a credit union, it’s easy to connect with the customer service team for valuable help tailored to your needs.

Earn cashback with every purchase

The Navigator Platinum Rewards card is another great way to pay for school supplies. For a limited time, we’re offering a low 4.99% introductory APR on purchases for six months! There’s also no annual fee, no balance transfer fee and no cash advance fees. Cardholders also earn unlimited uChoose® rewards. You can redeem the points for thousands of options – including cashback. Learn more about this limited-time offer by visiting navigatorcu.org/your-card.

1Source: Bankrate

2Source: CompareCards.

3Source: Credit Card Insider.

4Source: National Credit Union Administration.

APR=Annual Percentage Rate. Credit eligibility requirements apply. New cardholders pay a 4.99% introductory APR for the first 6 billing cycles from account opening. After that, the APR will be 10.90% and 12.90% based on creditworthiness. Offer subject to change without notice. See Visa agreement for uChoose Rewards® terms and conditions. uChoose Rewards® is a registered trademark of Fiserv Solutions, Inc. Visa® is a registered trademark of VISA Inc.

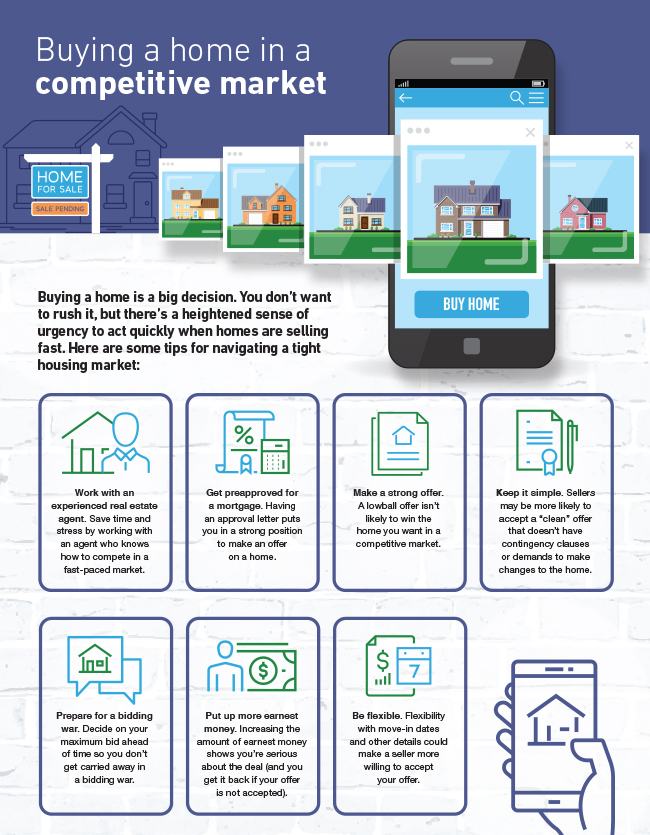

Home

Home