Step 1

Mobile Deposit

With mobile deposit, deposit checks from anywhere with your smartphone.

Open the Navigator App and select “Deposit” from the mobile banking menu. Select the account to deposit the funds and

enter the amount of your check.

Step 2

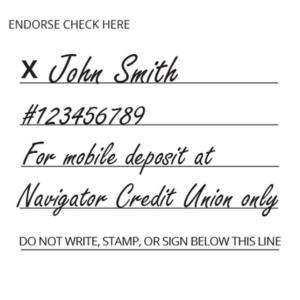

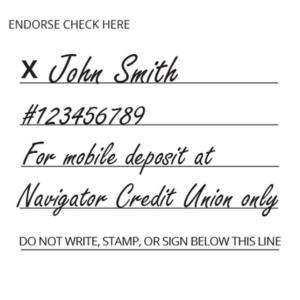

Take a picture of the front and back of your check endorsed with your name, account number and “For mobile deposit to Navigator CU only”.

Step 3

Receive a pop-up confirmation of your deposit to your Navigator account.

Frequently Asked Questions

What is mobile deposit?

Mobile deposit allows you to deposit a check to your Navigator account by taking a picture using your smartphone or tablet.

Is there a fee for using this service?

Mobile deposit is a FREE service for Navigator members. We do recommend checking with your mobile service provider to inquire about cellular data fees.

How does mobile deposit work?

To begin using mobile deposit, you must install the Navigator Credit Union mobile app on your smartphone or tablet. You can download the app by searching for “Navigator Credit Union” in the iTunes or Google Play store. Once app installation is complete, select “Deposit” from the mobile banking menu and follow the system prompts to make a successful deposit.

*You must endorse the back of your check prior to using mobile deposit. If not endorsed, the app will prompt you to sign the back of the check before proceeding with the deposit.

Is mobile deposit safe and secure?

Yes! You must login to Navigator digital banking using our mobile app to access mobile deposit. Our online banking system uses industry-high standards to safeguard your personal information including multi-factor authentication for identity verification. For added security, photos of your checks are never stored on your mobile device.

*Be sure you never give out your user ID and password. This information is created by you to protect your account online.

When will the funds be credited to my account?

When you deposit a check via mobile deposit, it will be available in two days in most cases. You will be able to view this pending transaction in the Navigator mobile app and online banking.

How quickly can I withdraw the money after making a mobile deposit?

Once the deposit no longer says pending, you may withdraw the money after making the mobile deposit

How will I know if my deposit was successful?

You will receive a pop-up confirmation instantly. If there is an error with processing your deposit, you will be prompted to contact the credit union for further details.

What should I do with my check after completing a mobile deposit?

If your mobile deposit is successful, you will be prompted to write the Deposit ID on the back of the check. After the check has posted to your account, you may retain this check for your records or destroy it after a recommended 30-day waiting period.

I just opened my Navigator account, can I begin using mobile deposit immediately?

You must be a Navigator member for 90 days before you can use mobile deposit. Navigator members in good standing are eligible for mobile deposit, daily deposit limits, and number of days on hold based on various criteria.

What types of checks are accepted with mobile deposit?

Checks must be from a U.S. institution and in U.S. dollars. You may use Navigator’s mobile deposit service to deposit original paper checks that are made payable to the name of the account holder and issued within the last six months. Examples of checks accepted for deposit include:

- Personal checks

- Business checks

- Government/Treasury checks

- Cashier’s checks

- Payroll checks

The following account-types will not be able to accept a mobile deposit:

- New Account (eligible after 90 days)

- Guardian Share

- Trust Share

- Conservatorship Share

- Organizational Share

- Representative Share

- Insurance Repairs

- Estate Share

- Construction Share

- VISA Secure Share

- Save ’N Up Share

- Membership Share

- IRA accounts or certificates (with the exception of a 6 month First Nvestor CD.)

Can I use this service for deposits to business accounts?

Yes, as long as the business account meets the mobile deposit requirements, it is eligible to use mobile deposit.

Is there a limit to the amount of money I can deposit using this service?

Mobile deposits are available in amounts up to $5,000 per day based on credit worthiness and membership criteria.