Flexible terms

Preferred auto dealers

Convenient vehicle loans

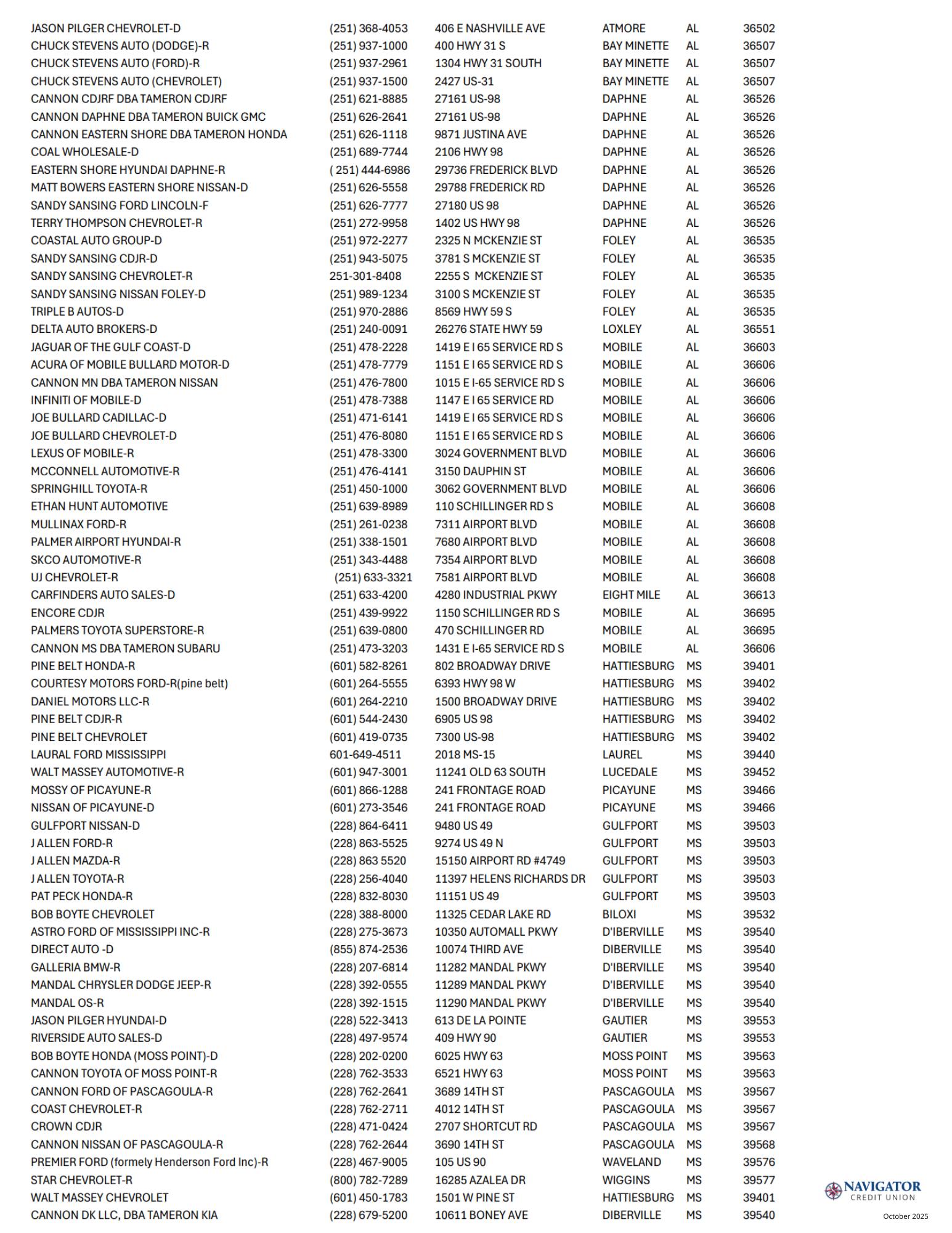

- More than 60 preferred dealers

- Sign your loan papers at the dealership

- No extra trips, no hassle

- Get the best loan rates available from Navigator

Same low rates for new and used vehicles

Affordable GAP coverage

Indirect lending FAQs

Yes, you can apply for an auto loan online even if you have not yet found the car you want. If you’re not a member of navigator yet, you may still apply for a loan online.

In some instances, a pre-approval will help you during the car buying process.

Options to apply for an auto loan:

- Online – apply for a loan online.

- Phone – Loan representatives are available from 9:00 a.m. to 56:00 p.m. Monday through Friday. Call (800) 344-3281.

- Branch – Stop by any of our branch locations to apply for a loan.

- Dealerships – Loan applications can be processed by any of our participating dealerships.

No, we finance private sales too. Options to apply for an auto loan:

- Online – apply for a loan online.

- Phone – Loan representatives are available from 9:00 a.m. to 56:00 p.m. Monday through Friday. Call (800) 344-3281.

- Branch – Stop by any of our branch locations to apply for a loan.

- Dealerships – Loan applications can be processed by any of our participating dealerships.

In some instances, a pre-approval will help you during the car buying process.

Loan qualifications differ depending on the type of loan you are applying for. The best way to find out if you qualify for a loan is to apply.

Options to apply for an auto loan:

- Online – apply for a loan online.

- Phone – Loan representatives are available from 9:00 a.m. to 56:00 p.m. Monday through Friday. Call (800) 344-3281.

- Branch – Stop by any of our branch locations to apply for a loan.

- Dealerships – Loan applications can be processed by any of our participating dealerships.

Applying for an auto refinance is easy. Complete an application online, over the phone or at a branch location.

Options to apply for an auto loan:

- Online – apply for a loan online.

- Phone – Loan representatives are available from 9:00 a.m. to 56:00 p.m. Monday through Friday. Call (800) 344-3281.

- Branch – Stop by any of our branch locations to apply for a loan.

- Dealerships – Loan applications can be processed by any of our participating dealerships.

If you are facing difficulty managing your loan payments, please don’t hesitate to reach out for assistance. Our team of friendly financial coaches are here to help. Our specialists are Certified Financial Counselors. We can discuss your situation and explore options together to find a solution that works for you.

Preferred dealers

Get pre-approved today

Car Affordability Calculator

Explore Loans

Direct Car Loans

Auto Refinance

Auto loan calculator

Get pre-approved today

* APR = Annual Percentage Rate (APR). The APR can vary based on a borrower’s credit profile, age of vehicle, loan term, loan-to-value ratio, and/or vehicle mileage. Borrower’s rate can be higher depending on your credit performance. Membership and credit eligibility requirements apply. Based on $10,000 loan with a 4.99% APR for 36 months, monthly payments will be $299.66. Additional credit and collateral criteria may apply. Rates and terms are subject to change without notice. Federally insured by NCUA. Terms and conditions apply.