To report unauthorized transactions on your Navigator credit card (those transactions where you did not provide your card number to the merchant, you must first report your credit card as lost or stolen.

Mobile Banking

experience and even more freedom to manage your finances with ease, at home or on the go.

Download our mobile app today

If you’re not already enrolled in online banking or don’t have our Navigator Mobile App, click the appropriate link or button to get started.

Registration Instructions

Instructions to register for digital banking:

Mobile App Frequently Asked Questions (FAQs)

What is Navigator’s routing number?

Navigator’s Routing Number is 265377950

How do I find my account number?

Select the account (share or loan) you want to find the full account number. Click the Details tab then it will be under the “Account Number” column. Account numbers are used for deposits and payments.

What if I forgot my password?

- On the login page, click the Forgot Password link.

- Enter your Username, date of birth and the last six (6) digits of your social security number.

- Select if you would like to receive a secure access code via text, call, voice message, call our Member Contact Center or receive push notification (if enabled).

- Enter the secure access code in the text box field.

- Enter your new password and confirm.

- You will be logged in to Online Banking and your new password will be in place.

How do I update my contact information?

- From the dashboard, select the profile icon on the top right and click the Profile

- Update your personal information and click SAVE CHANGES

How does the joint account holder on my account get access to my Online Banking account?

Only primary account holders can sign up for online banking. Use the following steps to grant access to your joint account holder:

- From the online banking dashboard, click Manager Users then Add New User

- Fill out the necessary information including the new user’s name and contact information; create a username and password; and set the permissions you want the user to have.

- Once the profile is created, the joint account holder can log in using the credentials you created.

Note: As the primary account holder, you may edit or remove any users’ access to your account at any time.

Can I customize the titles and accounts seen on my dashboard?

Yes. On the dashboard, click Customize on the same tile as the welcome message. Select which tiles you want to see by toggling them on or off. You may also choose which accounts are on display on the left-hand menu. Click Save to update your dashboard.

How do I add or change my account nicknames?

- Select the account (share or loan) from the left-hand menu you want to modify.

- On the Account Details page, click on the Details tab

- Click the pencil icon to edit the Account Nickname then click Update.

How do I view and download my documents and statements?

- From the dashboard, click the ellipsis menu (…) on the top right.

- Select Documents and Statements in the dropdown menu.

- You will be given the option to view all eligible statements.

How do I place a stop payment on a check?

You can place a stop payment on a single check, a series of checks or an ACH transaction.

- From your dashboard, click on the ellipsis menu (…) at the top right.

- Select Stop Payment from the dropdown menu.

- Follow the instructions to submit a stop payment.

How do I reorder checks?

- On the Quick Links tile on the dashboard, click Order Checks.

- You will be redirected to the Main Street check order site.

Note: Your initial check order must be done in-branch or by calling the Member Contact Center at (800) 344-3281.

How do I connect with another financial institution to view?

- From your online banking dashboard, select +Connect a Financial Institution at the bottom of the left-hand menu.

- Select the financial institution you wish to connect with. You may need to search for it using the search bar.

- Enter your financial institution’s online banking credentials.

- A random code will be sent to your preferred delivery method.

- Enter the code and select Submit.

Once verified, you will have access to only view your account’s balances and transactions.

How can I set up an external account to transfer money to and from another financial institution?

You can set up an external account after your account has been open for 90 days by using instant account verification if the primary account holder’s name is the same at both institutions.

- On the Dashboard, select Make a Transfer from the top menu bar.

- Select External Account then choose Another Account.

- Find your other financial institution by using the search bar.

- Enter your account information and select Next.

- You may also add the external account manually by entering your account number and routing number.

- Trial deposits will be sent to that account within 24-48 hours.

- Once those deposits are verified, you have access to initiate transfers to and from the external account.

How do I make a loan payment using a debit or credit card?

Loan payments using another financial institution’s debit or credit card can be made by clicking on the Make a Loan Payment via Credit or Debit Card link on the Quick Links tile

How do I create a recurring transfer?

- Select Make a Transfer from the top menu bar.

- Select the accounts you wish to transfer between and enter the dollar amount.

- Select the frequency in the Occurs dropdown and select a Start Date and End Date.

- Select Review and Submit to save your changes.

How do I cancel or revise a recurring funds transfer?

- Click on Make a Transfer on the top menu bar.

- Select the Scheduled Transfers tab.

- Select the transfer you wish to cancel.

- You have the option to cancel only the next transaction (Cancel Next) or all remaining transactions indefinitely (Cancel Remaining).

- Select Yes to submit your changes.

Where do I find my credit card rewards?

Click on the Navigator Rewards link in the Quick Links tile of the dashboard.

Where do I find my credit card statements?

- From the dashboard, navigate to the Loans & Credit section on left side of the screen.

- Select Platinum Mastercard tile.

- View current transactions or export transactions by range of dates

Where can I find my credit card balance and minimum payment due information?

Cardholders can navigate to the Platinum Mastercard tile. The credit card balance, available balance, minimum payment and due date are available at the top of the page

How do I file credit card dispute?

1. Report my credit card as lost or stolen

- From your dashboard, navigate to your credit card account.

- Select Card Services.

- Select Report card lost or stolen

- In the pop-up window, verify mailing address then click

- Select one of the following reasons then click Continue

- I lost my card

- My card was stolen

- Someone used my card without my knowledge

2. File my credit card dispute

- From your online banking dashboard, navigate to the Platinum Mastercard tile

- Under the Activity tab, select the transaction in question

- Click Dispute

- Select the reason for the dispute and click next

- Type in the merchant name as it appears in the transaction and click next

- Review and submit

Credit card disputes may take up to 45 days for a resolution.

How do I turn my card on/off?

- Member must register for Advanced Card Controls:

- From your dashboard, navigate to your checking or savings account.

- Select Card Services

- Select Advance Card Controls

- Select Register

Once you are registered for Advanced Card Controls, you may turn your card on/off:

- From your dashboard, navigate to your checking or savings account.

- Select Card Services

- Toggle button to lock or unlock card

- Message will change from Card is Unlocked to Card is Locked or vice versa

How do I report my debit card lost or stolen?

- From your dashboard, navigate to your checking or savings account.

- Select Card Services.

- Select Report card lost or stolen

- In the pop-up window, verify mailing address then click

- Select one of the following reasons then click Continue

- I lost my card

- My card was stolen

- Someone used my card without my knowledge

- A new debit card will be mailed to your address on file within ten (10) business days.

How do I request a replacement debit card?

- From your dashboard, navigate to your checking or savings account.

- Select Card Services.

- Select Request a replacement card

- In the pop-up window, verify your mailing address then click

- A new debit card will be mailed to your address on file within ten (10) business days.

- A replacement debit card fee may apply

How do I file a debit card dispute?

To report unauthorized transactions on your Navigator debit card (those transactions where you did not provide your card number to the merchant, you must first report your card as lost or stolen.

1. Report my debit card lost or stolen

- From your dashboard, navigate to your checking or savings account.

- Select Card Services.

- Select Report card lost or stolen

- In the pop-up window, verify mailing address then click

- Select one of the following reasons then click Continue

- I lost my card

- My card was stolen

- Someone used my card without my knowledge

2. File my debit card dispute

- From your online banking dashboard, navigate to your checking or savings account.

- Under the Activity tab, select the transaction in question

- Click Dispute

- Select the reason for the dispute and click next

- Type in the merchant name as it appears in the transaction and click next

- Review and submit

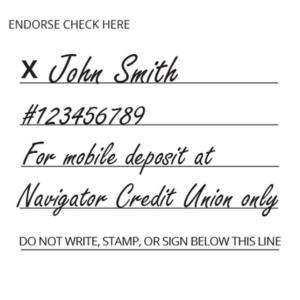

How do I deposit a check using mobile banking?

- Members will need the Navigator mobile app to use the mobile deposit feature.

- Properly endorse the back of the check you are depositing

-

-

- Sign your name

- Include your account number

- Write “For mobile deposit to Navigator CU only”

-

-

- Log in to the mobile app using your online banking username and password

- Click the Deposit icon

- Choose the Deposit Account and Amount of the deposit

- Take a photo of the front and back of the check

- Click Submit Deposit

You must be a Navigator member for 90 days before you can use mobile deposit. Navigator members in good standing are eligible for mobile deposit, daily deposit limits, and number of days on hold based on various criteria.

Can I make Member-to-Member transfers?

Yes, you can set up a Navigator member to receive transfers in two ways.

- On the dashboard, click Make a Transfer tab then add select Add a Member Account

- Choose whether you would like to add the Member by using their Account Number or use a M2M Code.

-

- If you’re adding using their Account Number, fill out all the fields including account number, suffix or loan number, account nickname and account type then click Add

Account. - If you’re adding the Member using a M2M Code, fill in the Member Code and Account Nickname then select Add Account.

- If you’re adding using their Account Number, fill out all the fields including account number, suffix or loan number, account nickname and account type then click Add

-

- You must get the M2M code from the Member you’re adding before starting this process. The code can be generated in the Create tab.

What type of account alerts can I set up?

Account alerts let you know when certain events happen. There are four types of alerts:

- Date Alert– Date Alerts are alerts that offer a convenient reminder of important dates or events.

- Account Alert– Account Alerts are alerts triggered based on changes to your account details.

- History Alert– History Alerts are processed transaction alerts triggered based on historical transaction details.

- Transaction Alert– Transaction Alerts are transaction-based alerts triggered based on the type of online transactions.

How do I sign up for advance card controls?

- From your dashboard, navigate to your checking or savings account.

- Select Card Services.

- Select Advance Card Controls

- Select Register

How do I change advance card controls?

- From your dashboard, navigate to your checking or savings account.

- Select Card Services.

- Toggle button to turn on/off the following:

- Lock/Unlock card

- Block International in-store transactions

- My Regions – deny in-store transactions if the merchant location is outside a selected region. Up to five (5) regions may be selected

- Enable Merchant Control – select the merchant types you would like to allow

- Enable Transaction Control – select the transaction types you would like to allow

- Spending Limits – set dollar amount limits per transaction or by month

How do I change advance card alerts?

- From your dashboard, navigate to your checking or savings account.

- Select Card Services.

- Toggle button to turn on/off the following subscription alerts:

- Alert me when there is an in-store international transaction

- Alert me when in-store transactions occur outside my regions

- Alert me for these types(s) of merchant transactions:

- Department store, Entertainment, Gas station, Restaurant, Grocery and/or Travel

- Alert me of these types(s) of transactions:

- In Store, eCommerce and/or ATM

- Alert me when I exceed the following spending limits

- Limit per transaction – Fill in the amount

- Limit per month – Fill in the amount

How do I set up or change alerts?

- From your dashboard, click on the ellipsis menu (…) at the top right of your screen.

- Select Alerts from the dropdown menu.

- Review and confirm the alerts you want to be activated by toggling on and off then click Save.

How can I receive account alerts?

You can select the Alerts you would like to receive by choosing Alerts from the dropdown menu on the top right of the screen on the dashboard. Alerts are delivered in the following ways:

- Email Notification– An email notification will be sent when your alert is triggered. Email notifications are sent at 5:00 a.m. and 2:00 p.m. CST.

- SMS Text Message Notification – A text message will be sent to your mobile device. If you choose a text notification, you should enter the desired time you want

to receive the text any day the alert triggers. - Push Notifications– A push notification is a real-time alert and message similar to a text/SMS that you receive on your Apple or Android device when you have the Navigator Mobile App installed. You can opt-in to receive push notifications of your security alerts.

Note: Depending on your mobile plan, you may be charged for text messages. Standard text messaging fees apply

Where can I see my preferred alert delivery method?

You can edit or enable your preferred alert delivery method by selecting Alerts in the (…) menu. You can manage Subscription Alerts, Security Alerts and Mobile Alerts along with check your Alert History.

Can I log into Digital Banking when I’m traveling abroad?

Navigator’s digital banking services are available in most countries allowing you to access your account information in the same way you do here at home. However, some countries require the use of a VPN, a “virtual private network” that protects your internet connection and privacy online. To use a VPN, download a VPN program or smartphone app such as NordVPN and point to a U.S. VPN to log in. Countries that require Members to use a VPN are:

- Brazil

- China

- Cuba

- Iran

- North Korea

- Malaysia

- Philippines

- Russia

- Syria

- Ukraine

- Vietnam

Members using TOR (The Onion Router), also require a VPN.

Why is my current location not correct in the mobile app?

Your location is generated by your phone and not our mobile app. There are several factors why it may be incorrect. The location may reflect your cell phone network and not your physical location. The signal bounces off a satellite and chooses the nearest IP location. Also, when signing in with a mobile device, you may be routed through an IP address that doesn’t reflect your actual location.

Why am I being asked to register my computer at every login?

If you are being prompted to register your computer every time you log in, your browser might not be allowing cookies. Online Banking places a cookie on your computer when you register your browser. This lets our system know you have confirmed and trust the computer being used.

If you are not accepting cookies or deleting them, then you will be prompted to register your computer.

Note: If you have a security program that clears your Internet cookies, or if you clear them manually, you will be required to re-register your computer. You may choose to adjust this setting in your browser’s Tools or Internet Options settings. Please be aware that the system prompts for a code to be entered for security purposes when login behavior or your location changes. This is an enhanced security feature and cannot be turned off.

Why do we have to use multi-factor authentication and how does it work?

Multi-factor authentication is an added security measure to ensure that we are upholding our member promise of protecting member’s privacy. Members can complete this via text message, voice call, or email.

What does error 1020 mean?

Error 1020 means that your IP address is being blocked. This is common for those who use a VPN, Anti-Virus or WIFI blocker. For security, our system will block an IP if it cannot be verified. To address this issue, you must disable your VPN, Anti-Virus or WIFI blocker to gain access to our system.

Mobile app features:

Personalized dashboard

Customize your home page to manage your finances the way you want.

Member to member transfers

Instantly transfer funds to another Navigator member.

Mobile check deposit

Deposit checks right from your mobile device.

e-Statements

Access account statements on your smartphone.

Bill Pay

Schedule bill payments to individuals or businesses.

Personal Financial Assistant

Connect your financial accounts in a simple and secure way so you can make informed financial decisions.

Secure Messaging

Protected two-way communication between you

and our friendly team members.

Transaction Alerts

Set up balance or transaction alerts.

Share Access

Flexibility to determine which permissions to assign to a sub-user on your account.