Understanding your credit score is crucial for navigating the financial landscape. It affects your access to loans, interest rates and even rental approvals. Navigator Credit Union breaks down key factors influencing your score and offers actionable strategies to build a solid credit foundation.

Understanding Your Credit Report

The first step is familiarity. You are entitled to free annual credit reports from each major bureau (Experian, TransUnion, and Equifax). Regularly review these reports for accuracy and dispute any errors promptly. Even minor mistakes can impact your score.

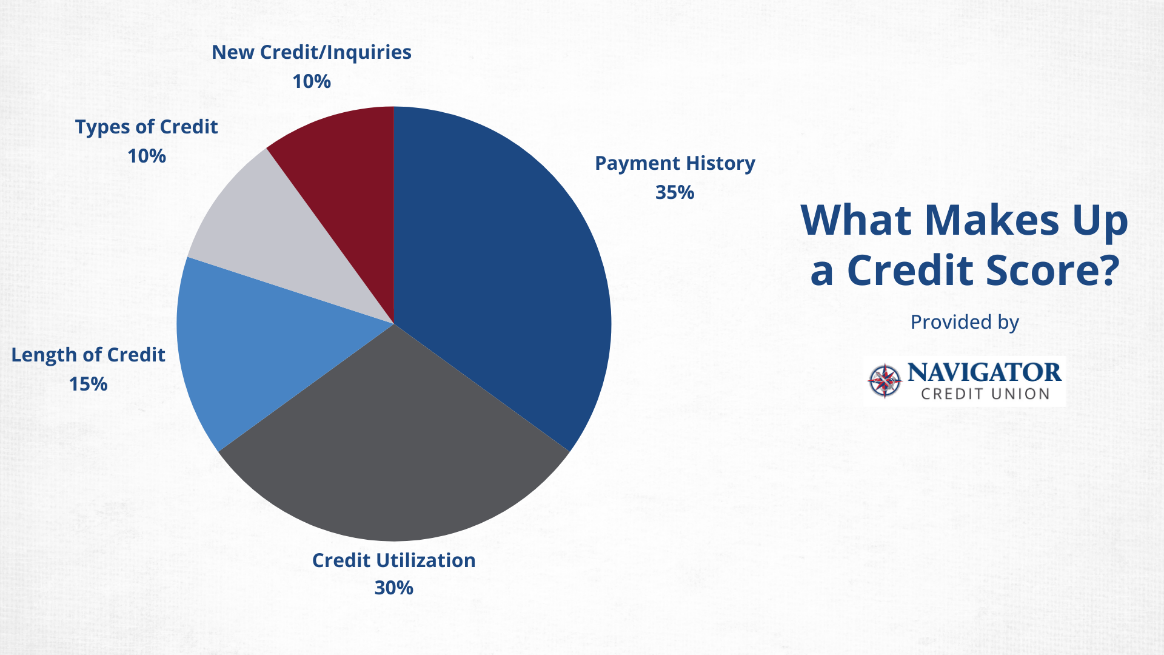

What Shapes Your Credit Score

Contrary to popular belief, credit scores go beyond simply “good” or “bad” debts. Credit Scores are calculated based on several factors, with payment history being the most crucial (35%). Other important contributors include credit utilization (30%), length of credit (15%), types of credit (10%), and new credit or inquiries (10%).

Strategies for Building Credit

Building a solid credit foundation takes time and discipline. The most important thing to remember is to pay your bills on time. Set up automatic payments or reminders. Even one late payment can do some major damage. Other strategies include becoming diversifying the type of credit you have and using 30% or less of your available credit.

Common Pitfalls to Avoid

While building or rebuilding credit takes time, you can dodge some common pitfalls to speed up your progress.

-

- Avoid carrying high credit card balances;

- Ignoring bills, even small ones, can leave lasting scars;

- Closing old accounts can erase valuable credit history; and

- Applying for too many loans or credit cards in a short span triggers inquiry red flags.

Building good credit is a journey, not a destination. By understanding the key factors, making informed choices and avoiding common pitfalls, you can unlock a future filled with financial opportunities.