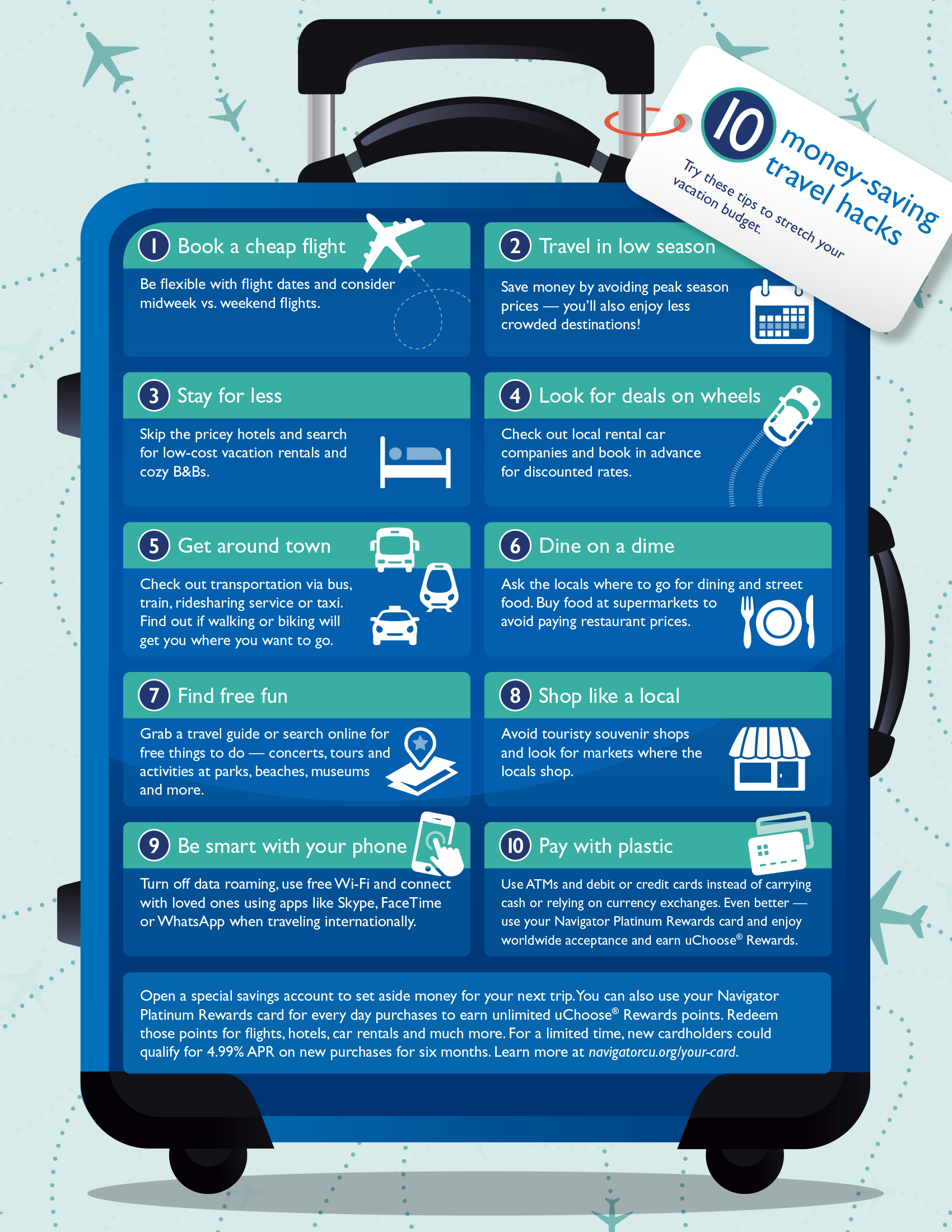

10 Money-Saving Travel Hacks

Navigator can help make the most of your travel budget. Open a special savings account to set aside money for your next trip. You can also use your Navigator Platinum Rewards card for every day purchases to earn unlimited uChoose® Rewards points. Redeem those points for flights, hotels, car rentals and much more. For a limited time, new cardholders could qualify for 4.99% APR on new purchases for six months. Learn more at navigatorcu.org/your-card.

New cardholders pay a 4.99% introductory APR for the first 6 billing cycles from account opening. After that, the APR will be 10.90% and 12.90% based on creditworthiness. Offer subject to change without notice. See Visa agreement for uChoose Rewards® terms and conditions. uChoose Rewards® is a registered trademark of Fiserv Solutions, Inc. Visa® is a registered trademark of VISA Inc. All offers are subject to credit approval and membership eligibility. Federally insured by NCUA.

Home

Home